The new year brings updated tax thresholds, deductions, and credits — and for millions of Americans, that means changes to what they’ll owe the IRS.

What’s Changing in 2026?

Inflation Adjustments and Legislative Updates

The IRS annually adjusts tax brackets to prevent “bracket creep,” where inflation pushes taxpayers into higher brackets without real income growth. For 2026, brackets increase roughly 2.7% overall, with extra boosts for lower brackets under the new One Big Beautiful Bill Act (OBBBA).

Deductions, Credits & Other Adjustments

Several other key elements change in 2026:

- Standard deductions rise across the board.

- Seniors (65+) receive a larger additional deduction.

- The State and Local Tax (SALT) deduction cap increases to $40,000.

- Some clean energy and miscellaneous deductions phase out.

- Alternative Minimum Tax (AMT) thresholds increase to protect middle-income filers.

- Capital gains tax brackets adjust upward.

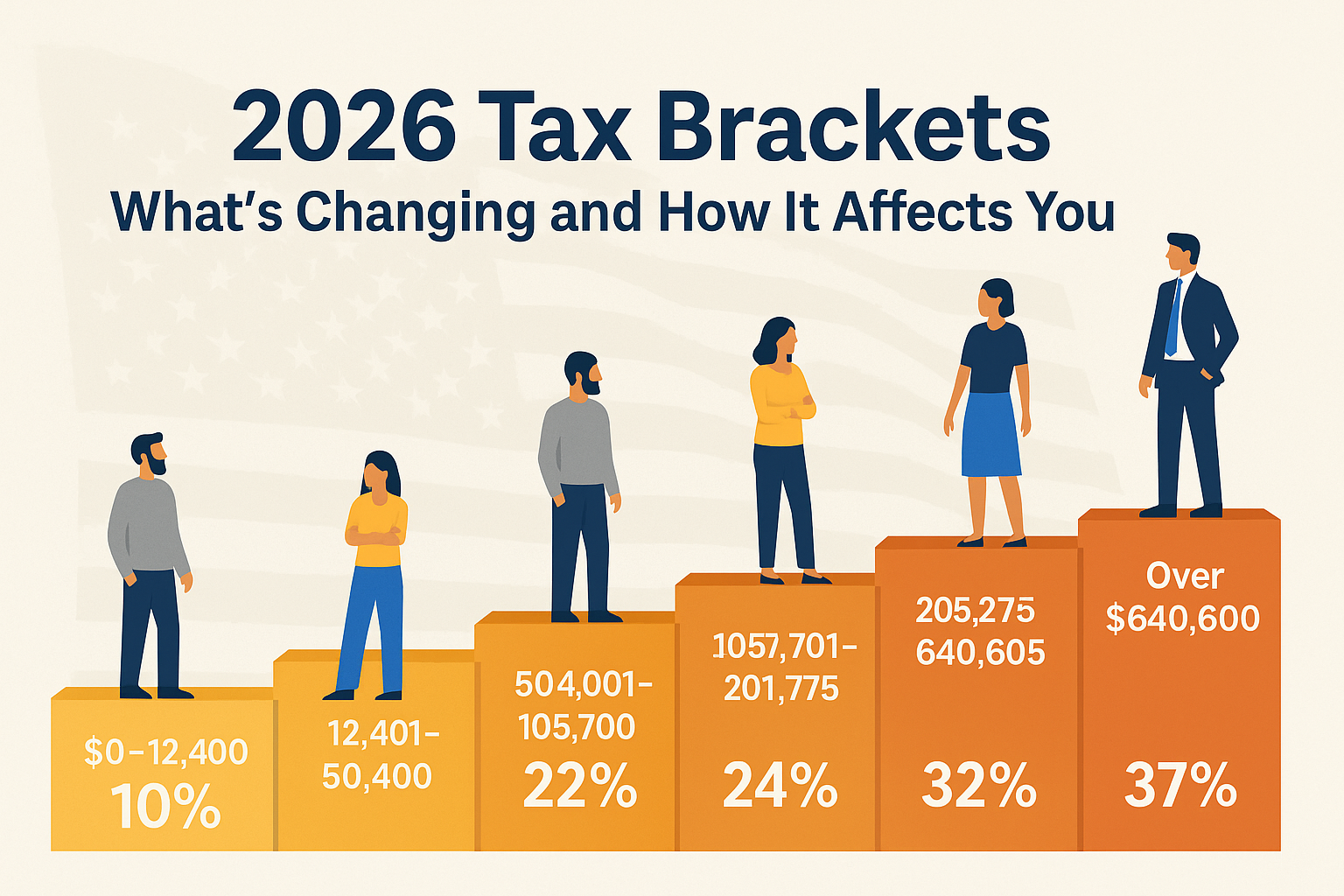

2026 Federal Tax Brackets and Standard Deductions

Filing Status | 10% | 12% | 22% | 24% | 32% | 35% | 37% |

Single | $0–$12,400 | $12,401–$50,400 | $50,401–$105,700 | $105,701–$201,775 | $201,776–$256,225 | $256,226–$640,600 | Over $640,600 |

Married Filing Jointly | $0–$24,800 | $24,801–$100,800 | $100,801–$211,100 | $211,101–$403,550 | $403,551–$512,450 | $512,451–$768,700 | Over $768,700 |

Standard Deductions (2026)

- Single: $16,100

- Married Filing Jointly: $32,200

- Head of Household: $24,175

Senior Additional Deduction (65+)

- Single: +$6,000 (phased out above $75,000 income)

- Married Filing Jointly: +$12,000 (phased out above $150,000 income)

Who Benefits — and Who Doesn’t

Likely Winners

- Middle-income earners: Avoid bracket creep and may see lower effective rates.

- Seniors: Larger standard deduction and new senior deduction mean lower taxable income.

- High-tax state residents: Higher SALT cap offers added relief.

- Families with children: Child tax credit continues and modestly increases.

Mixed or Negative Impacts

- High-income taxpayers: Fewer benefits as phase-outs limit deductions.

- Itemizers: Loss of certain deductions (like unreimbursed work expenses).

- Clean energy investors: Some energy credits expire or scale back.

- If TCJA expires: Portions of the 2017 Tax Cuts and Jobs Act may lapse, raising taxes for many.

Tax Planning Tips for 2026

- Adjust your withholding: Avoid surprises by updating W-4s for the new brackets.

- Time income and deductions: Accelerate deductions or defer income to stay in lower brackets.

- Use credits before they expire: Act on green energy incentives while they’re still available.

- Reevaluate retirement strategies: The bracket shifts may change whether Roth conversions make sense.

- Stay informed: Keep up with final IRS adjustments and possible TCJA extensions.

Key Takeaways

- Rates stay the same; thresholds rise.

- Most middle earners and retirees benefit modestly.

- Some deductions and credits end — plan accordingly.

- Smart planning in late 2025 can help you save in 2026.

FAQ

Q: When do these new brackets apply?

A: For income earned in 2026 (tax returns filed in 2027).

Q: Do these affect state income taxes?

A: No — states set their own brackets, though some mirror federal changes.

Q: Are the rates changing?

A: No, only the income thresholds shift.

Q: Will capital gains rates change?

A: No, but the income levels for each capital gains bracket will increase.

Q: Could Congress alter this again?

A: Yes. Some parts of current law could change before or after 2026 depending on budget and election outcomes.

Sources

- MarketWatch – The IRS Just Released Its 2026 Tax Brackets

- Bloomberg Tax – 2026 Tax Projections

- Vancouver CPA – 2026 Federal Income Tax Brackets and Standard Deduction Amounts

- Kiplinger – What You Should Do Before 2026

- Tax Foundation – 2026 Tax Brackets and the TCJA Expiration

- efile.com – Tax Brackets 2025–2027

- Finger Lakes 1 – IRS Tax Bracket Changes 2026